Corporate innovation is becoming increasingly important in the business world as companies strive to stay competitive and capitalize on emerging technologies. My 20+ years of experience as a corporate innovator in Cincinnati have allowed me to gain valuable insights into the benefits and challenges of engaging in innovation. In this blog post, I will provide an overview of corporate innovation, discuss its benefits and challenges, reflect on my experiences as a corporate innovator turned innovation scout at Cintrifuse, and share key takeaways about the future corporate innovation.

Corporate innovation is the practice of businesses introducing new products, services, processes, or strategies to stay ahead of changing markets and technologies to obtain a competitive edge. Businesses have several different strategies available to them when it comes to developing new products and services. These include internal research and development (build), strategically gaining equity in other companies (invest), leveraging partnerships with other companies (partner), or making acquisitions of startups that already have cutting-edge solutions (buy). Each strategy has advantages and drawbacks that must be considered before deciding.

Companies such as Apple, Amazon, Microsoft, and Cincinnati Children’s Hospital Medical Center are examples of successful businesses that have successfully implemented corporate innovation strategies, providing them with a powerful edge over their competitors. Benefits such as increased efficiency, cost savings, and access to new markets are some potential positive outcomes of corporate innovation, while the challenges of complexity and high costs must also be taken into account. When deciding which approach to take, it’s important for companies to consider their core competencies and how these skills can be used for the best outcome. By carefully evaluating their various options, businesses can find an approach that gives them a competitive advantage.

Build

Building has traditionally meant creating something from scratch and leveraging internal resources and personnel. However, new ways to approach this strategy now result in less risk than building internally. For example, companies can utilize hackathons, accelerators, venture studios, and other tools to quickly prototype their idea and test it in the market before investing more time or money into development.

Utilizing hackathons, accelerators, and venture studios are new ways for corporations to rapidly prototype their ideas and test them in the market without investing heavily in research and development. For example, the upcoming Rethink Recycling Hack-a-thon is an exciting example of bringing together multiple stakeholders from across industries, such as corporate partners like Coca-Cola, OVG, Fifth Third Bank, Kroger, Madtree, Michelman, Pepsi, and P&G; civic partners; and tech startups all working to address current recycling challenges in Cincinnati.

The hackathon allows all parties involved to gain valuable insights while helping pave the way for more efficient recycling systems that can make a real difference in reducing contamination levels and increasing overall success rates. Using such strategies, corporations can stay on top of trends and capitalize on opportunities before their competitors. Ultimately, this approach helps them remain competitive in an ever-changing business landscape. Additionally, such methods enable large corporations to learn from external entities by taking advantage of existing networks or connecting with experts from outside their industry. Ultimately, this strategy can benefit those with limited resources who want to develop a unique product or service.

Partner

The Duke Energy and Electrada partnership is a pioneering pilot project for fleet EV charging at Duke Energy’s Mount Holly Technology and Innovation Center. This collaboration also involves Daimler Truck North America (DTNA), the largest heavy-duty truck manufacturer in North America, as a founding participant. This program aims to provide fleet customers with an efficient path to electrification while reducing long-term energy costs and performance risks.

Cincinnati’s Electrada will benefit from this partnership by gaining access to new customers interested in their seamless 360 Charging-as-a-Service solutions, efficiently eliminating the complexity involved with fleet electrification. Meanwhile, Duke Energy can study grid performance management and energy integration through various testing scenarios. Finally, DTNA also has the opportunity to demonstrate to its customers the advantages of transitioning to electrified fleets. As a result, all three parties stand to gain valuable insights that will help shape the future of fleet electrification.

This collaboration is an excellent example of how corporations like Duke Energy can partner with external companies to accelerate innovation and progress toward more sustainable solutions. For example, the pilot program will help EV fleets to become more mainstream by providing customers with an efficient path to electrification that reduces long-term energy costs and performance risks. Thus, by breaking down barriers to entry for fleet customers, this collaboration is paving the way for EV fleets to become a more viable option in the transportation industry.

Invest

Investing in startups through corporate venture capital arms offers an attractive opportunity for established companies to access cutting-edge technologies and markets without fully assuming the financial burden of ownership. Cincinnati Children’s Hospital Medical Center (CCHMC) exemplifies this strategy, having invested in Clarigent Health, a digital health startup using artificial intelligence to develop predictive analytics for mental health assessments. Founded by a former researcher and faculty member of CCHMC, Dr. John Pestian, Clarigent Health was spun out of CCHMC with the help of their investment arm, Cincinnati Children’s Innovation Ventures (CCIV). As a result, not only did CCHMC provide financial support to Clarigent Health, but they also provided guidance from their expertise in pediatric mental health. In return, CCHMC gained access to Clarigent Health’s technology and expertise to improve patient care and outcomes.

This example shows that corporate investments in startups can lead to meaningful innovations as an excellent way for local corporations to stay ahead of their competition while fostering growth potential within the Cincinnati startup ecosystem. By leveraging investments as strategic moves and creating a pipeline of opportunities leading to bigger wins, corporations can remain agile in uncertain times while minimizing risk and encouraging innovation. Ultimately, investing offers tremendous potential for both parties to benefit from each other’s resources, giving rise to innovations that have the potential to yield lasting competitive advantage.

Buy

Buying is a powerful tool for corporations seeking access to technologies or customer bases. It can provide companies with the resources they need in a cost-efficient and timely manner, but corporate strategists must treat it as an investment rather than a quick-fix solution. By assessing potential risks associated with buying, evaluating hidden advantages of acquisition, and ensuring that value is retained in the newly acquired company, corporations can confidently make informed decisions that will benefit their organization for years.

As illustrated by Workday’s recent acquisition of VNDLY, understanding the benefits of strategic buyouts can help corporations remain competitive and grow their market presence in the long run. Through this purchase, Workday solved its customers’ pain points by providing a single platform to manage contingent workforces quickly and efficiently. In addition, the technology acquired gives customers access to automated processes, an open marketplace, and real-time analytics. Ultimately, M&A efforts require significant resources but can pay off – allowing corporations to remain innovative and ahead of their competitors. Moreover, by strategically assessing these risks and leveraging the power of acquisition, companies can utilize this potent tool to reach their goals more quickly than possible.

Impact of Corporate Culture

Organizations looking to take advantage of corporate innovation must know how their culture can affect their ability to innovate. Companies with a culture that is resistant to change or does not encourage collaboration amongst teams and open communication between all parties involved may stifle innovation efforts. Additionally, processes should be streamlined to reduce bureaucracy and increase agility. Furthermore, sufficient resources and rewards must be provided for employees willing to take risks to foster an environment that promotes creativity and rapid technological advancement while mitigating associated risks. By addressing these components, businesses can have a much better chance of success when engaging in such practices.

Reflection

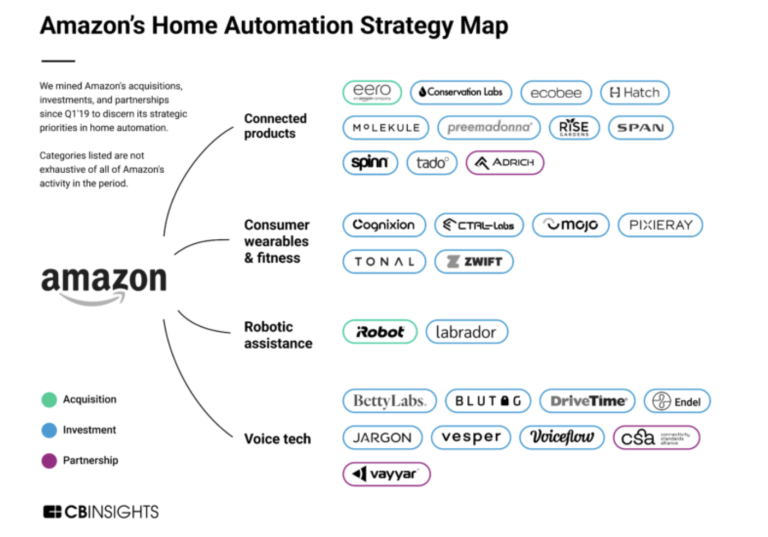

The most successful companies simultaneously leverage all four strategies—build, partner, invest, and buy—and create ecosystems of external partners. By creating an interconnected network of startups and subject matter experts, these organizations can better manage the risks associated with innovation without depending on a single source for new products or services. For instance, Amazon has invested heavily in forming strategic partnerships with voice tech, wearables companies, and other service providers to extend its reach into home automation markets. The market map below from CB Insights perfectly illustrates this ecosystem of partners. Over the years, we have seen Cincinnati corporations improve and excel at this overall approach.

Corporate innovation has tremendous potential for businesses looking to keep up with changing technologies and outpace their competition. By taking advantage of external networks while developing internal capabilities, businesses can achieve greater agility with their innovation strategies and remain competitive in a rapidly changing market. Therefore, companies should strive to create an environment that encourages external collaboration and partnerships alongside internal development to stay ahead of the competition.

ABOUT CINTRIFUSE’S VENTURE SERVICES

We provide comprehensive solutions tailored to maximize corporate innovation in greater Cincinnati by creating curated ecosystems of startups and subject matter experts with our processes for deal sourcing, technology selection, and startup access. In addition, Cintrifuse’s Syndicate Fund of Funds network, local startups, and portfolio startup network aid us in identifying potential solutions for businesses and connecting them to relevant subject matter experts through curated connections to facilitate knowledge transfer. Through these services, the Venture Services team helps companies to stay competitive in today’s ever-evolving market by leveraging external networks to drive success.