A dream team of venture capitalists and founders participated in Cintrifuse’s first virtual event to showcase the FinTech Frontier, the future-focused partnership between Cincinnati-based, industry-leading financial services corporations and Fintech-focused entrepreneurs, powered by Cintrifuse, Cincinnati’s startup catalyst.

Western & Southern Financial Group and Fifth Third Bank are the founding partners.

The initiative was launched in early September with a series of virtual events designed to accelerate the future of finance from the Greater Cincinnati region, which will continue through October. The first virtual event explored the topic of “How FinTech is pivoting in the age of pandemic, extreme disruption, and bold new possibilities.”

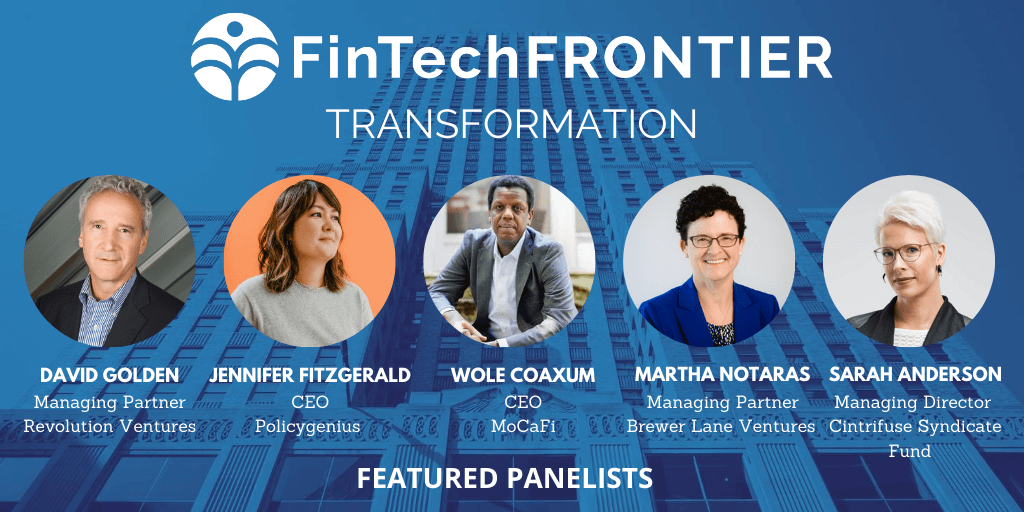

Led by Sarah Anderson, who manages the Cintrifuse Syndicate Fund, the panel included:

- David Golden, Revolution Ventures

- Jennifer Fitzgerald, Policygenuis

- Martha Notaras, Brewer Lane Ventures

- Wole Coaxum, MoCaFi

The panel noted there is tremendous interest in FinTech now, driven largely by the pandemic, in areas of creating customer loyalty using trusted digital platforms, managing and de-escalating fraud issues and providing liquidity for small businesses. The founders from Policygenius and MoCaFi shared their pandemic pivots.

The thrust for innovation has intensified in several areas of FinTech, especially in providing services to underbanked communities. More than 50 percent of Hispanics and 55 percent of African Americans in the United States have no access to banking services. Wole Coaxum, Founder of MoCaFi or Mobility Capital Finance, Inc., is working to provide greater access by creating a digital platform for the underbanked and currently has 25,000 users and growing.

Unsurprisingly, life insurance applications are on the rise during the first half of 2020. Policygenius, an online insurance marketplace is working to digitize insurance offerings, is led by Jennifer Fitzgerald, who said her company had its best second quarter in company history, due in large part to the pandemic.

The panel shared their advice for start-ups who may be interested in participating in the FinTech Frontier’s Pitch Competition to accelerate the best and boldest ideas to create the future of fintech. A prize pool of $60,000 will be awarded to winning pitches that address the challenges posed by FinTech Frontier founding partners.

As Cintrifuse works to drive efficiencies between big companies and start-ups, collaboration will continue be the key to success. These partnerships will enable the incumbents to pivot to offer blended solutions among start-ups working together to solve big problems.

While big companies may not be able to innovate and pivot as quickly as start-ups, they can fund the initiatives which will solve big, hard problems assembling the most talented team available. The panelists also urged start-ups to imagine new paradigms on how to digitize the FinTech industry to reach new audiences such as the underbanked or small businesses.

Next Up:

September 17, 11:30 a.m.-1 p.m.

FinTech Personalization: How FinTech is embracing artificial intelligence (AI) and machine learning to be more precise, more personal and more private at the same time.

Registration for the Fintech Personalization is available here.